Category Archives: Latest News

The Government announced on December 28, 2025 that the annually updated aggregate list of eligible universities under the Top Talent Pass Scheme (TTPS) will take effect on January 1, 2026

The Governmentannounced on December 28, 2025 that the annually updated aggregate list of eligible universities under the Top Talent Pass Scheme (TTPS) will take effect on January 1, 2026.

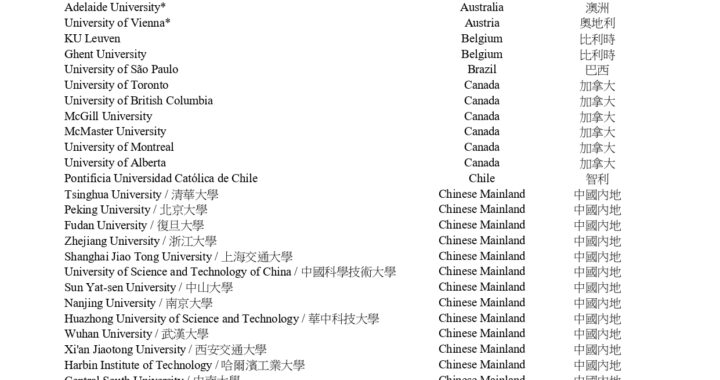

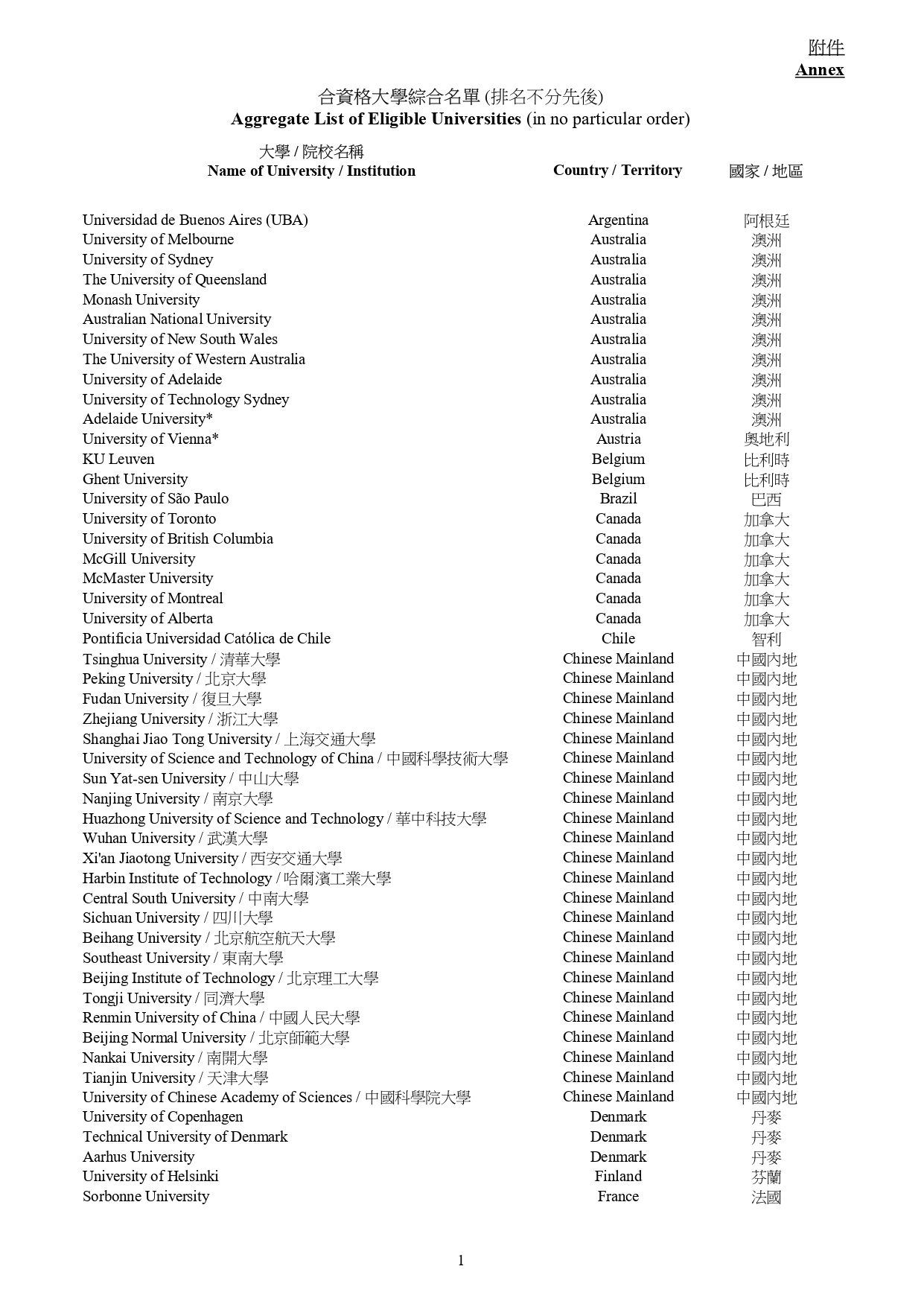

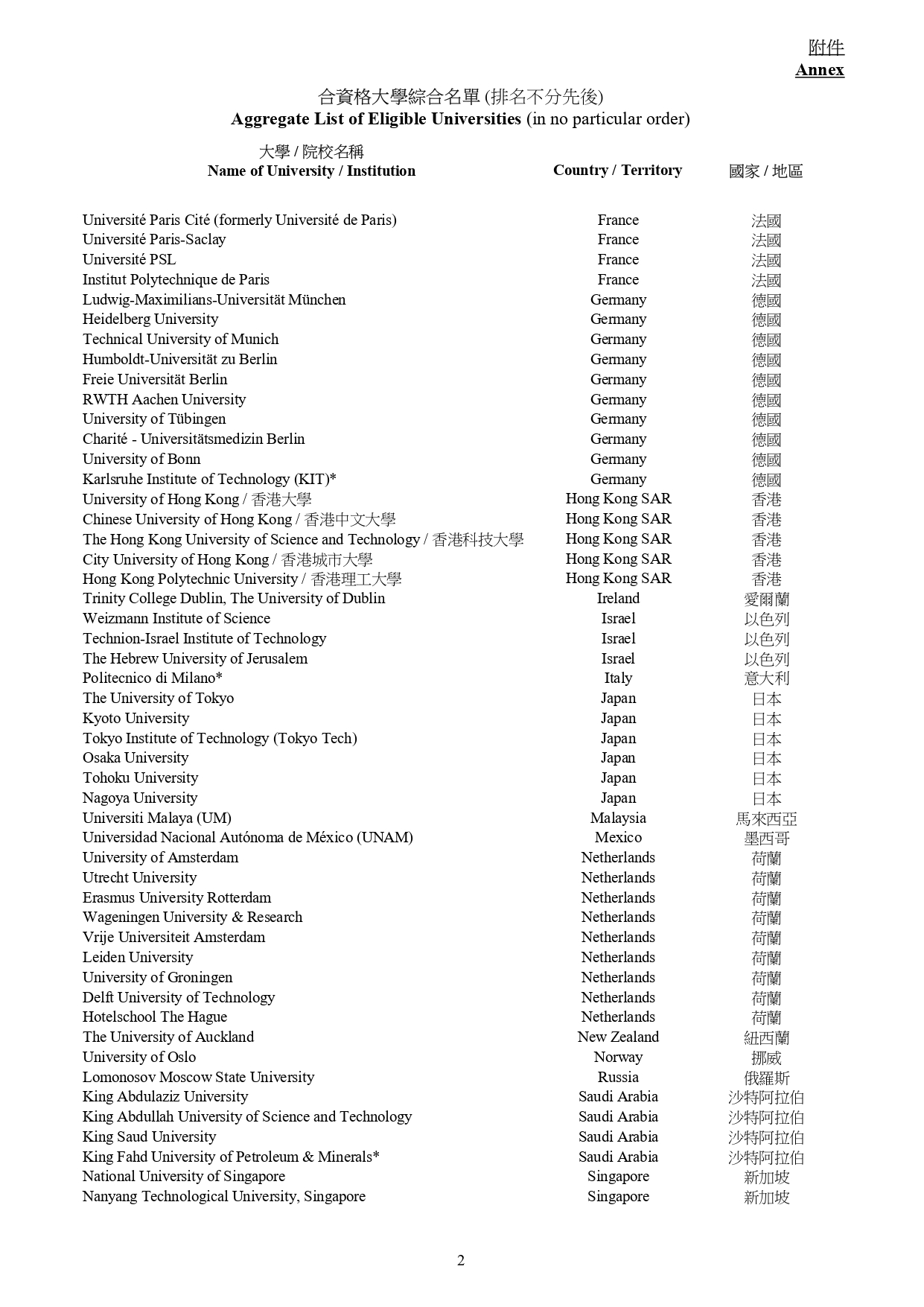

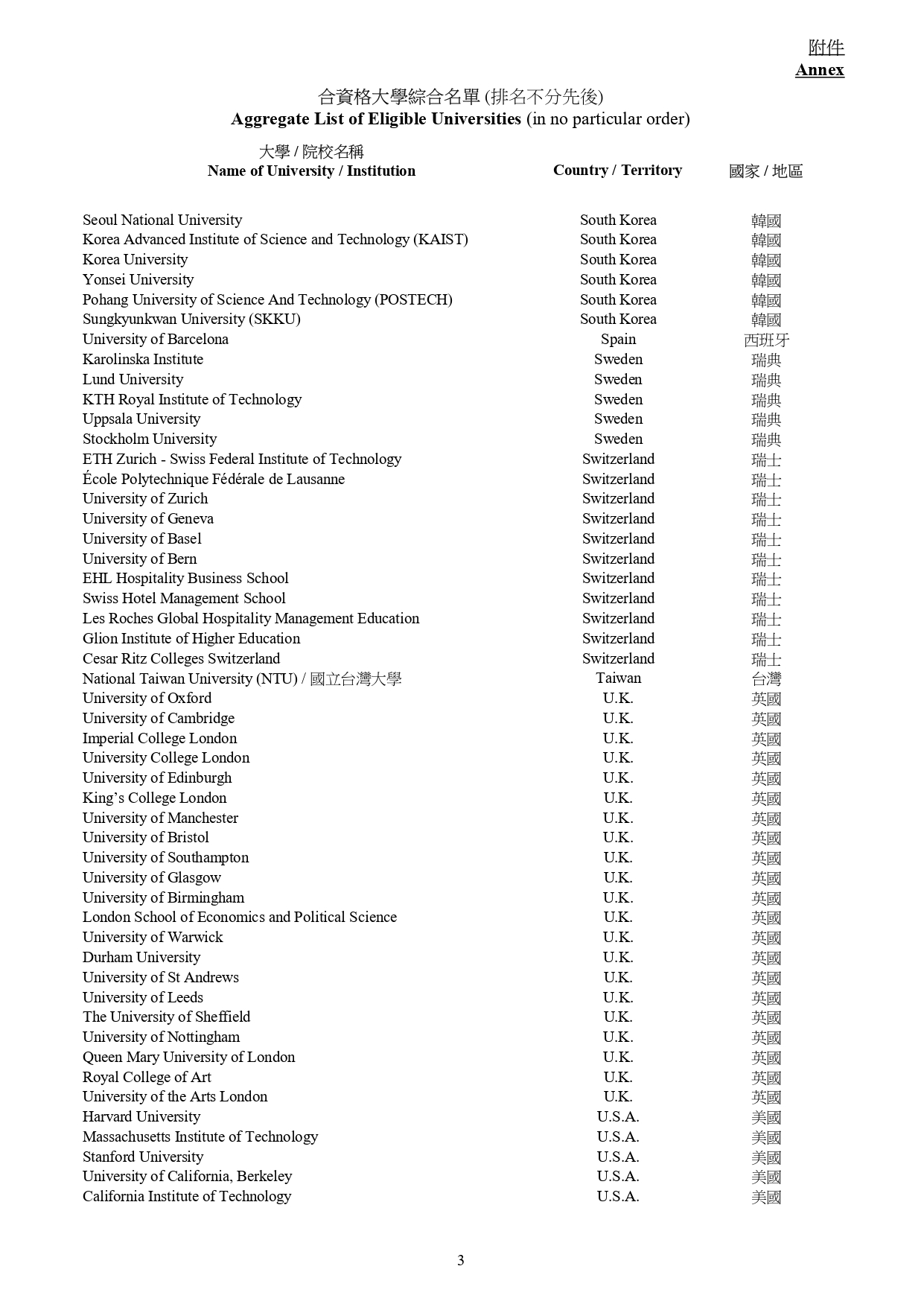

Four universities were removed, and five new universities were added, increasing the total number from 199 to 200.

The newly added universities include Adelaide University in Australia, the University of Vienna in Austria, the Karlsruhe Institute of Technology in Germany, Politecnico di Milano in Italy, and King Fahd University of Petroleum & Minerals in Saudi Arabia.

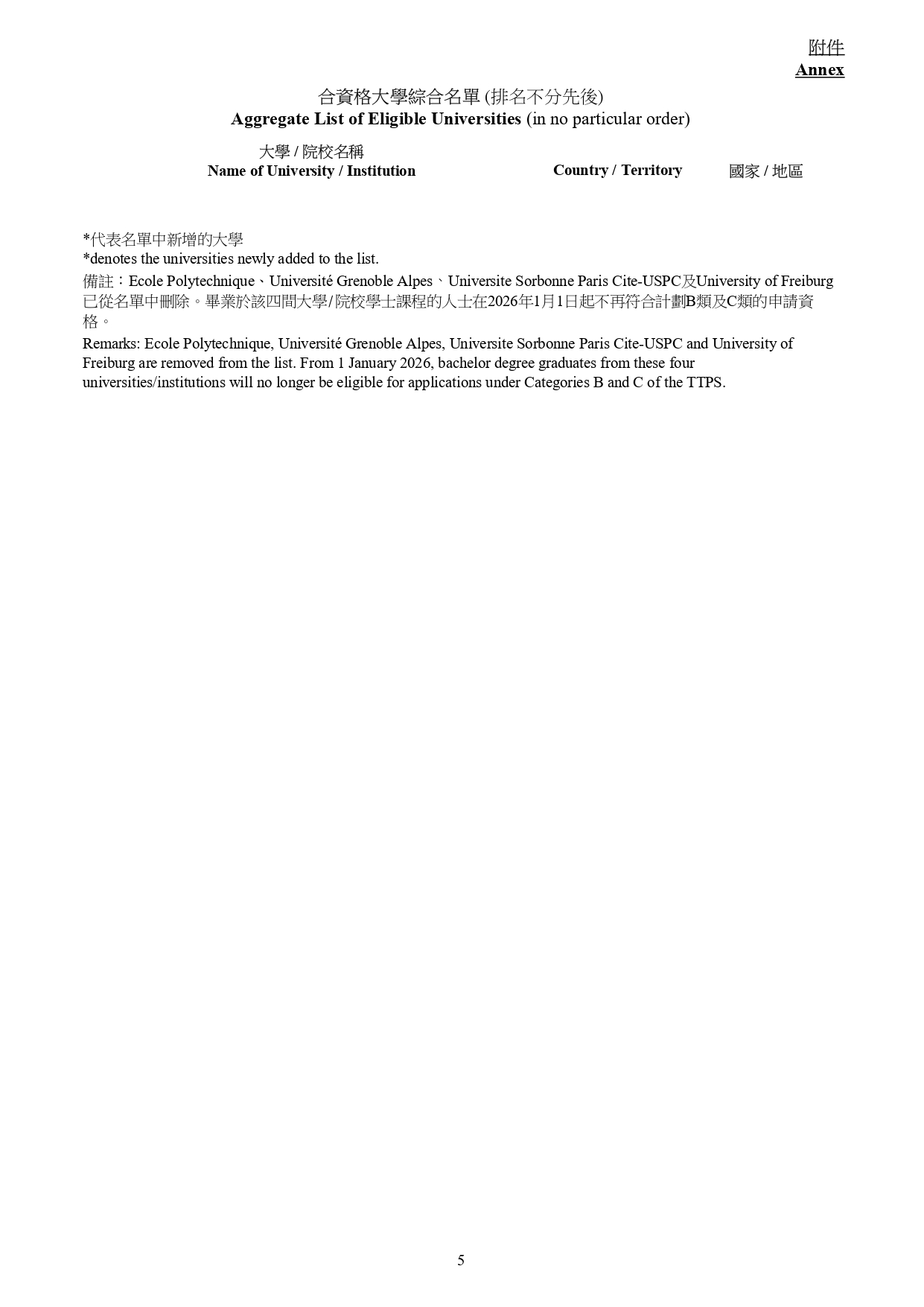

The four universities removed include three French universities: Ecole Polytechnique, Université Grenoble Alpes, and Universite Sorbonne Paris Cite-USPC, and the University of Freiburg in Germany.

The TTPS aims to attract talent in the following three categories:

Category A: persons with annual income reaching HK$2.5 million or above in the year immediately preceding the date of application;

Category B: full-time bachelor’s degree graduates of the universities/institutions prescribed in the aggregate list (eligible universities/institutions) with at least three years of work experience over the past five years immediately preceding the date of application; or

Category C: full-time bachelor’s degree graduates of eligible universities/institutions in the past five years immediately preceding the date of application with less than three years of work experience.

The Financial Services and the Treasury Bureau and Invest Hong Kong today (January 7) announced the details of various enhancement measures for the New CIES, which will take effect from March 1, 2025.

The Financial Services and the Treasury Bureau and Invest Hong Kong today (January 7) announced the details of various enhancement measures for the New CIES, which will take effect from March 1, 2025.

(a) Fulfilment of net asset requirement (NAR)

(i) An applicant under the New CIES is only required to demonstrate that he/she has net assets or net equity to which he/she is absolutely beneficially entitled with a market value of not less than HK$30 million net throughout six months (two years before the enhancement) preceding the application; and

(ii) Net assets or net equity jointly owned with the applicant’s family member(s) can now be taken into consideration for the calculation of the NAR for the respective portion which is absolutely beneficially entitled to the applicant.

(b) Holding permissible investment assets through a Family-owned Investment Holding Vehicle (FIHV) or a Family-owned Special Purpose Entity (FSPE) under an FIHV

Investments made through an eligible private company wholly owned by an applicant will be counted towards the applicant’s eligible investment in the New CIES.

An eligible private company refers to a holding company incorporated or registered in Hong Kong which is wholly owned by an applicant in the form of an FIHV or an FSPE under an FIHV managed by an eligible single family office as defined in Section 2 of Schedule 16E to the Inland Revenue Ordinance (Cap. 112). The enhancement will create synergy between the New CIES and establishment of family offices in Hong Kong.